RBI’s move will help businesses mitigate financial stress: India Inc

MUMBAI : Prime Minister Narendra Modi on Friday hailed that steps takes by the Reserve Bank of India (RBI) and said it will greatly enhance liquidity and improve credit supply.

MUMBAI : Prime Minister Narendra Modi on Friday hailed that steps takes by the Reserve Bank of India (RBI) and said it will greatly enhance liquidity and improve credit supply.

During his address today, the RBI Governor announced a slew of measures to maintain adequate liquidity in system, facilitate bank credit flow and ease financial stress.

The RBI on Friday reduced the reverse repo rate – the rate at which banks park their fund with the central bank – by 25 basis points to encourage banks to lend to the productive sectors of the economy.

The Bank announced a slew of measures including re-finance window of Rs 50,000 crore and targeted long term repo auction of similar amount to deal with the impact of the COVID-19 pandemic.The reverse repo rate cut will discourage banks from parking cash with the RBI and encourage them to lend to the economy.

The Reserve Bank of India unexpectedly cut its key deposit rate for the second time in three weeks on Friday to discourage banks for parking idle funds with it and push them toward lending to revive the flagging economy amid the coronavirus lockdown.

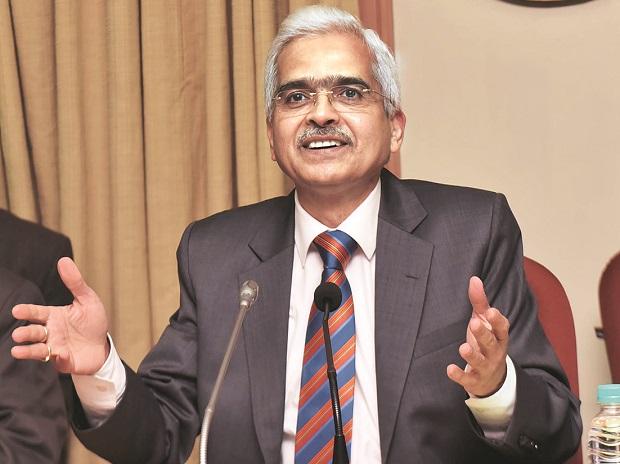

The RBI cut its reverse repo rate by 25 basis points (bps) to 3.75 per cent with immediate effect, Governor Shaktikanta Das said in a video conference. The rate had already been cut by 90 bps last month. The central bank kept its benchmark repo rate unchanged at 4.40 per cent after a 75-bps cut last month.

RBI Governor S K Das said RBI will use all instruments at its disposal to deal with the challenges posed by the outbreak of the novel coronavirus, depending on the evolving situation. He said there are a few slivers of brightness amidst the encircling gloom and hoped that India will stage a sharp V-shaped recovery in 2021-22 as projected by the International Monetary Fund (IMF).

The central bank also allowed states to borrow 60 per cent more via ways and means advance facility available and extended the increased limit until September 30. To preserve capital, RBI asked banks not to pay any further dividends for the fiscal year ended March 31. The dividend curbs will be reviewed in the quarter ending September 30.

The RBI had on March 27 announced a steep 75 basis points cut in the repo rate, slashed cash reserve ratio and permitted a three-month moratorium on all loans, including home loans, extended by commercial banks and lending institutions.

SBI Chairman Rajnish Kumar, who also heads industry lobby grouping IBA, called the measures, which included both regulatory as well as liquidity interventions, as “rightful recognition to the evolving market conditions” by RBI. “Overall, the second set of package by RBI is an excellent reflection of combining the policy response and regulatory responses in the most optimal manner,” he said in a statement.

Kumar said the second set of targeted long term repo operations will help non-bank lenders and micro lenders. He also welcomed the refinancing support for SIDBI, NHB and NABARD, saying deserving sectors will get help.

British lender Standard Chartered Bank’s country chief executive Zarin Daruwala called the announced measures second booster shot to the economy from RBI within a month, and added that steps like reducing liquidity coverage ratio requirements and NPA relief during moratorium will improve credit delivery appetite.

Padmaja Chunduru, the managing director and chief executive of the state-run Indian Bank, said RBI’s tone is full of empathy and support to the needy sectors of the economy. Small businesses and retail borrowers will benefit through the 90-day extension in NPA recognition for stressed standard assets, while the 90-day extension given for NCLT filing in cases of bad loans will save banks 20 per cent in provisions, she said.

(Bureau Report with Inputs from Agencies).