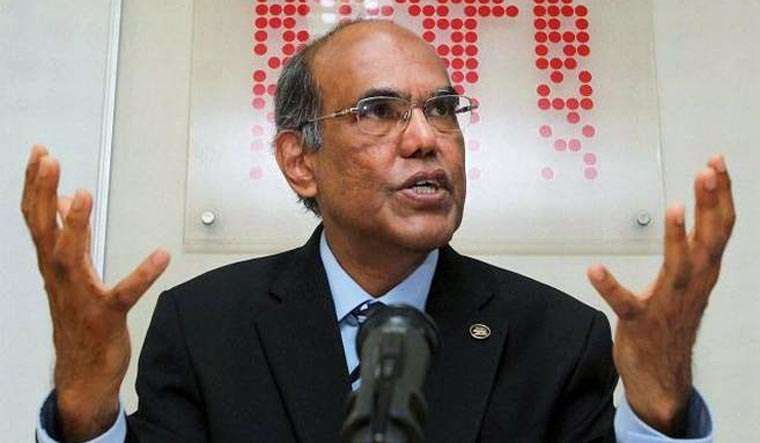

Prolonged lockdown may push millions into Poverty: Ex RBI Gouv.Subbarao

NEW DELHI : A prolonged lockdown may possibly push million of Indians into the “margins of subsistence”, former RBI Governor Duvvuri Subbarao said on Sunday while expecting a ‘V’ curved recovery once the COVID-19 crisis ends and the turnaround in India to be faster than some economies.

NEW DELHI : A prolonged lockdown may possibly push million of Indians into the “margins of subsistence”, former RBI Governor Duvvuri Subbarao said on Sunday while expecting a ‘V’ curved recovery once the COVID-19 crisis ends and the turnaround in India to be faster than some economies.

While expecting a ”V” curved recovery once the COVID-19 crisis ends and the turnaround in India to be faster than some economies. He was participating in a webinar on “History repeats – but differently- Lessons for the post Corona World,” organised by the Manthan Foundation here, in which former Deputy Governor of RBI Usha Thorat took part.

“Because most analysts believe that this year India will actually have negative growth or growth will contract. We must remember that even ahead of the crisis two months ago our growth slowed. Now it has completely stopped.” he said.

Last year growth was five per cent. Just imagine, five per cent growth last year and we are going to negative or zero growth this year, a decline of five per cent growth,” he said.

“It is true that India is going to perform in this crisis better than most other countries.But that is no consolation….Because we are a very poor country and if the crisis persists and if the lockdown is not lifted soon enough, it is quite possible that millions of people will be pushed into the margins of subsistence, he said when asked about his views on the present situation.

According to him, India”s recovery was faster than many other countries after the 2008 global financial crisis. On IMFs prediction that India may grow at 1.9 per cent during the current year against about five per cent in the last fiscal, Subbarao said many analysts feel that the prediction is outdated and the growth in GDP may slip into negative.

He said the “life versus livelihood” dilemma for the country is arguably very “short while” for India. Usha Thorat said pumping more liquidity into the system alone cannot work and banks and Non-Banking Finance Companies (NBFC) will need credit guarantee or enhancement to start lending.

She also said that states need more support during the crisis and streamlining of non-merit subsidies was required.

(Bureau REport with Agency Inputs ).