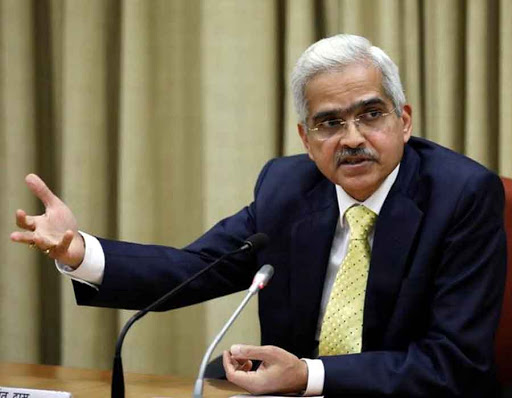

Pandemic may lead to higher NPAs Says RBI Governor

NEW DELHI : The global financial crisis of 2008-09 and the COVID-19 pandemic in 2020 have rocked the financial system within a span of a decade.

NEW DELHI : The global financial crisis of 2008-09 and the COVID-19 pandemic in 2020 have rocked the financial system within a span of a decade.

The current crisis may leave a longer impact on Indian economy, which is predicted to contract in FY21 for the first time in four decades said Reserve Bank of India (RBI) governor Shaktikanta Das on Saturday

“It is still uncertain when supply chains will be restored fully; how long will it take for demand conditions to normalise; and what kind of durable effects the pandemic will leave behind on our potential growth,” the Governor said.

He said that the Coronavirus outbreak is the worst health and economic crisis for the country in last 100 years with unprecedented negative consequences for output, jobs and well-being.

RBI Governor’s statement came as a sounding alarm on India’s economic outlook in the days to come as country continue to fight against Covid-19 both physically and economically.

In a keynote address at the 7th SBI Banking and Economics Conclave, Das noted that medium term outlook still remains uncertain as the Covid-19 pandemic has widely dented the existing world order, global value chains, labour and capital movements across globe.

The Central bank chief also said that it is needless to say that the socioeconomic conditions of large sections of the world population has been affected by the Corona virus outbreak.

“The COVID-19 pandemic perhaps represents so far the biggest test of robustness and resilience of our economic and financial system,” he said. Das, however, noted that despite substantial impact of pandemic in our daily lives, the financial system of the country, including all the payment systems and financial markets, are functioning without any hindrance.

“The Indian economy has started showing signs of getting back to normalcy in response to the staggered easing of restrictions. It is, however, still uncertain when supply chains will be restored fully; how long will it take for demand conditions to normalise; and what kind of durable effects the pandemic will leave behind on our potential growth,” he said.

The RBI Governor also elaborated that a multi-pronged approach adopted by the Reserve Bank has provided a cushion from the immediate impact of the pandemic on banks, however, the medium-term outlook is uncertain and depends on the Covid-19 curve.

Building buffers and raising capital will be crucial not only to ensure credit flow but also to build resilience in the financial system,” he said. According to Das, the RBI has asked financial institutions to carry out a Covid stress test to see weaknesses in their balance sheet.

“The economic impact of the pandemic due to the lockdown and anticipated post-lockdown compression in economic growth may result in higher non-performing assets and capital erosion of the banks,” Das cautioned.

Accordingly, he said RBI is placing special emphasis on the assessment of business model, governance and assurance functions, as these have been the are as of heightened supervisory concern.

In addition, he said that post containment of Covid-19, “a very careful trajectory has to be followed in orderly unwinding of counter-cyclical regulator y measures and the financial sector should return to normal functioning without relying on the regulatory relaxations as the new norm”.

(With Agency Inputs).