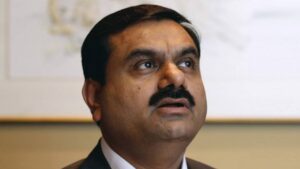

Indian Billionaire Gautam Adani no longer Asia’s 2nd richest person, loses $9 billion

MUMBAI: Indian Billionaire industrialist Gautam Adani has lost the title of the second richest person in Asia, only behind his Indian counterpart Reliance Industries Limited’s chief Mukesh Ambani. Gautam Adani’s lost more money this week than anyone else in the world, with his personal fortune tumbling by about $9 billion to $67.6 billion, according to the Bloomberg Billionaires Index based on Wednesday closing prices.

MUMBAI: Indian Billionaire industrialist Gautam Adani has lost the title of the second richest person in Asia, only behind his Indian counterpart Reliance Industries Limited’s chief Mukesh Ambani. Gautam Adani’s lost more money this week than anyone else in the world, with his personal fortune tumbling by about $9 billion to $67.6 billion, according to the Bloomberg Billionaires Index based on Wednesday closing prices.

Just days ago, he was closing the gap with Mukesh Ambani as Asia’s richest man. A sudden drop in the wealth of Adani came after the stock prices of many firms owned by him saw a plunge in their stock prices.Adani Group stocks continued to fall on Thursday.

The U-turn in shares started Monday after the Economic Times reported that India’s national share depository froze the accounts of three Mauritius-based funds because of insufficient information on the owners. The bulk of the holdings of Albula Investment Fund, Cresta Fund and APMS Investment Fund — about $6 billion — are shares of Adani’s firms. Although the Adani group called the report “blatantly erroneous” and said it was “done to deliberately mislead the investing community,” investors concerned over transparency rushed for the exit.

“There should be greater clarity to ensure who the final owners of the shares are,” said Hemindra Hazari, an independent research analyst in Mumbai. A spokesperson for the Adani Group declined to comment beyond the exchange filings sent this week. These overseas funds “have been investors in Adani Enterprises Ltd. for more than a decade,” Adani Group said in a June 14 statement. “We urge all our stakeholders not to be perturbed by market speculations.”

In identical exchange filings the same day, Adani group companies said that they had written confirmation from the Registrar and Transfer Agent that the offshore funds’ demat accounts in which Adani shares were held “are not frozen.” Shares of Adani Green Energy Ltd., the mogul’s most valuable asset, slipped 7.7% this week. Adani Ports & Special Economic Zone Ltd. plunged 23% in four days, Adani Power Ltd., Adani Total Gas Ltd. and Adani Transmission Ltd. tumbled at least 18%, while flagship Adani Enterprises fell almost 15%.

Excitement around the Adani empire spanning ports, mines and power plants had been building up over the past couple of years as the coal magnate looks beyond the dirtiest fossil fuel for expansion, seeking to dovetail his business interests with infrastructure priorities set by Prime Minister Narendra Modi.

In the past few days, Adani’s net worth has dropped to $63 billion. At the beginning of the ongoing week, his fortune stood at $77 billion, which means that the billionaire nearly lost $14 billion in just four days. In the last three days, he has lost $9 billion. Friday’s trading session could bring more shocks to 58-year-old Adani’s fortune. Also Read: Adani Group deploys resources for Covid fight, procures 48 oxygen carrying tanks

Notably, when Adani had become the second-richest person in Asia, many financial pundits were expecting that he might topple Ambani as well to become the richest man in the world’s largest continent. Overall, since the onset of the pandemic, Adani’s wealth has grown manifold. In April 2021, the Adani Group became only the third conglomerate in India with a market capitalisation of over $100 billion.

Six publicly listed Adani Group companies were trading at record highs just before the mayhem. With the ongoing setback, the predictions of Adani becoming the richest man in Asia now appear far away from becoming a reality anytime soon. Also Read: Gold Price Today, 17 June 2021: Gold slips by Rs 900, cheaper by Rs 8600 from record highs.

(With Agency Inputs).