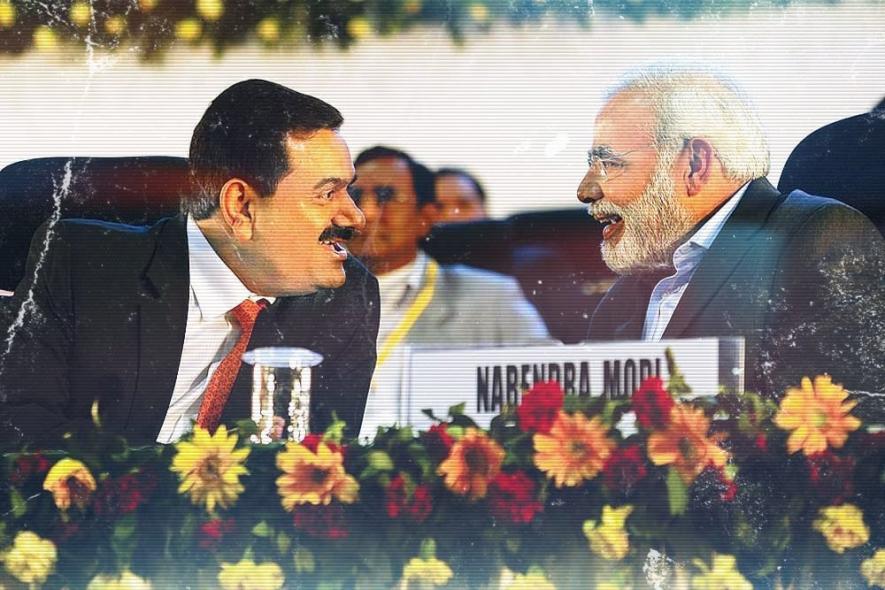

Gautam Adani to Take a Controlling Stake in Mumbai Airport

MUMBAI: Adani Enterprises would take a controlling stake in Mumbai International Airport Ltd (MIAL) through a deal in which Adani Airport Holdings Limited will acquire the debt of GVK Airport Developers Limited (GVK ADL).

MUMBAI: Adani Enterprises would take a controlling stake in Mumbai International Airport Ltd (MIAL) through a deal in which Adani Airport Holdings Limited will acquire the debt of GVK Airport Developers Limited (GVK ADL).

GVK ADL is the holding company through which GVK Group holds a 50.50% equity stake in MIAL, which in turns holds a 74% stake in Navi Mumbai International Airport Limited (NMIAL), Adani Enterprises said in a filing with exchanges.

Adani Group will also take steps to complete the acquisition of a 23.5% equity stake from the Airports Company of South Africa and Bidvest Group in MIAL for which it has obtained approval from India’s competition regulator, ADEL said.

India plans to build 200 additional airports and handle more than a billion domestic and international passengers, Mr Adani said in a statement, adding that over this period India’s top 30 cities are expected to require two airports.”Adani Airports sees itself well-positioned to help build the infrastructure platform required,” he said.

Earlier this week, Adani Airports, a subsidiary of Mumbai-listed Adani Enterprises, announced the acquisition of GVK Airport Developers Ltd’s 50.50 per cent stake in the Mumbai International Airport Ltd (MIAL). It will also buyout 23.5 per cent stake of Airports Company of South Africa (ACSA) and Bidvest Group to get a 74 per cent controlling interest in Mumbai airport.

“The Mumbai International Airport is absolutely world-class,” Adani said in a statement. “The addition of the Mumbai International Airport and the Navi Mumbai International Airport to our existing portfolio of six airports provides us a transformational platform that will help shape and create strategic adjacencies for our other B2B businesses.”

models,” he said. Adani said Mumbai is set to become one of the top 5 global metropolitan centres of the 21st century and is expected to be the nation’s leading airport as well as a core domestic and international hub.

This when passenger traffic across India is projected to grow 5-fold and the nation builds 200 additional airports to handle over 1 billion domestic and international passengers across the Tier 1, 2 and 3 cities, the majority of which will connect to Mumbai. “Over this p ..India’s top 30 cities are expected to each require two airports and Adani Airports sees itself well-positioned to help build the infrastructure platform required,” he said.

“Adani Airport Holdings intends to infuse funds into MIAL to ensure it receives much needed liquidity and also achieves financial closure of Navi Mumbai International Airport to be able to commence construction,” Adani Enterprises said. Shares of Adani Enterprises were down 4% in midday trading.

Mr Adani said the acquisition of Mumbai airport, along with the other six, will give the group a “transformational platform” and create strategic opportunities for its other businesses Adani Group, an industrial conglomerate with revenues of over $15 billion, has businesses across power, gas distribution, renewable energy, logistics, ports, roads and rail.

(Bureau Report with Agency Inputs).