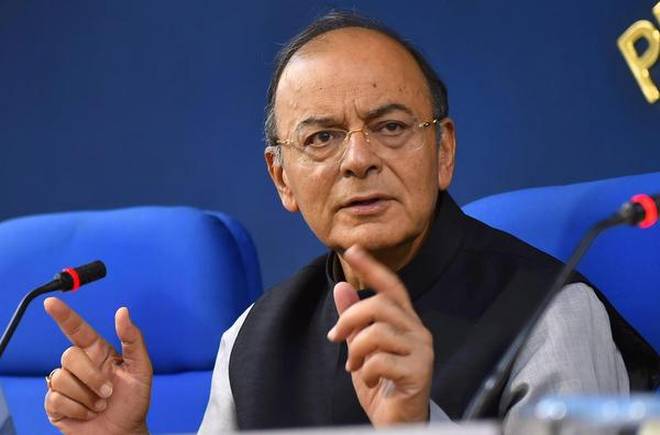

FM Arun Jaitley Blames “Global Reasons”For Plunging Rupee

NEW DELHI : Finance Minister Arun Jaitley today said the unprecedented fall of the rupee against the dollar was not confined to India and the reason for it was “global”.

NEW DELHI : Finance Minister Arun Jaitley today said the unprecedented fall of the rupee against the dollar was not confined to India and the reason for it was “global”.

There was no need for “panic and knee-jerk reactions”, said the finance minister hours after news agency Reuters reported that the Reserve Bank is likely to have stepped in to check the free-fall of the rupee.

Finance Minister Arun Jaitley on Wednesday remained non-committal on cutting excise duty to cushion spiralling petrol and diesel prices, which touched an all-time high, saying international oil prices are volatile and have not shown any linear movement.

Jaitley defended criticism that he and External Affairs Minister Sushma Swaraj as Opposition leaders had mounted against the previous UPA government on the issue saying inflation during those times was in double-digits and they would have failed in their duties if they had not criticised the government of the time for its failure to curb fuel prices contributing to further price rise.

India, he said, is a net buyer of oil and is adversely impacted when rates go up “temporarily”. He termed such movement s “an external factor”. “There is no straight line movement of global crude oil prices. They go up, they come down.

He was asked about petrol and diesel prices touching an all-time high and demands by opposition parties for a cut in excise duty.On asked if the government need to be prepared if crude prices go up further, he said, “Well policy formation is never a rigid process”.

Asked about the BJP criticising UPA when it was in Opposition on the issue, he said, “We rightly criticised the UPA government then because on inflation there is a huge difference between 11 percent during UPA and a consistent 4 percent inflation during NDA”.

“Our record on inflation management has been exemplary. We inherited an 11 percent inflation and certainly we would have been failing in our duty if Sushma ji and I as leaders of Opposition had not criticised it,” he said. The rally in fuel prices has been driven by rupee dipping to an all-time low, making imports costlier, and rise in crude oil prices.

The rupee has fallen to a record low of Rs 71.75 to a dollar, depreciating by over Rs three in a month. Also, crude oil has gained $7 a barrel in a fortnight, driven by fears that the US sanctions on Iran will likely contract supplies.

Petrol and diesel prices Tuesday touched fresh highs. Rates in Delhi rose to Rs 79.31 a litre for petrol and Rs 71.34 for diesel, renewing calls for a cut in excise duty to cushion the spike. Almost half of the retail selling price of the two fuel is made up of central and state taxes.

Prices have been on fire since mid-August, rising almost every day due to a combination of a drop in rupee value and rise in crude oil rates. While prices were not revised today, rates for petrol have gone up by Rs 2.17 per litre since 16 August, while diesel rates have climbed by Rs 2.62: the biggest increase in rates witnessed in any fortnight since the launch of daily price revision in mid-June last year.

The Centre currently levies a total of Rs 19.48 per litre of excise duty on petrol and Rs 15.33 per litre on diesel. On top of this, states levy Value Added Tax (VAT): the lowest being in Andaman and Nicobar Islands where a 6 percent sales tax is charged on both the fuel.(With Agency Inputs ).