Income Tax Rates Cut: New tax slabs announced

NEW DELHI : Beginning her presentation in parliament with a tribute to former Finance Minister Arun Jaitley who died last year, Ms Sitharaman termed the GST “historic structural reform”. Today’s Union Budget, the third in a span of one year, will seek to kickstart an economy staring at the worst pace of expansion recorded since the 2008-09 global financial crisis.

NEW DELHI : Beginning her presentation in parliament with a tribute to former Finance Minister Arun Jaitley who died last year, Ms Sitharaman termed the GST “historic structural reform”. Today’s Union Budget, the third in a span of one year, will seek to kickstart an economy staring at the worst pace of expansion recorded since the 2008-09 global financial crisis.

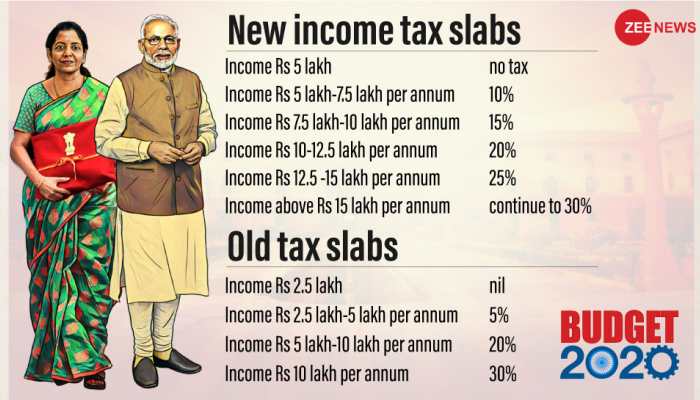

Budget 2020 has proposed a new tax regime slashing income tax rates and rejigging income tax slabs to reduce total tax payable by individuals. As per the new regime, 70 tax exemptions will be removed but the income between Rs 5 lakh and Rs 7.5 lakh will be taxed at 10% down from current 20%.

income between Rs 7.5 lakh and Rs 10 lakh will be taxed at 15% down from current 20% and income between Rs 10 lakh and Rs 12.5 lakh will be taxed at 20% down from current 30%. Income between Rs 12.5 lakh will be taxed at 20% down from current 30%. Income between Rs 12.5 lakh and Rs 15 lakh will be taxed at 25% down from current 30%. Incomes above Rs 15 lakh will continue to be taxed at 30%.

Budget 2020 has offered tax payers the option to choose between the existing income tax regime and a new regime with slashed income tax rates and new income tax slabs but no tax exemptions. The new tax regime offers lower tax rates and new tax slabs and simultaneously removes tax exemptions and will result in lower tax outgo for the tax payer, according to the finance minister

Currently, income up to Rs 2.5 lakh for resident individuals (age below 60 years) is exempt from tax. Similarly, for senior citizens aged 60 years and above but below 80 years, income up to Rs 3 lakh is exempt from tax. Income up to Rs 5 lakh is exempt from tax for super senior citizens (age 80 years and above).

Income tax rates for individuals below 60 years are as follows: No tax on income up to Rs 2.5 lakh, 5 per cent tax on income between Rs 250,001 to Rs 5 lakh; 20 per cent tax on income between Rs 500,001 and Rs 10 lakh; and 30 per cent tax on income above Rs 10 lakh.

For senior citizens (aged 60 years or above but less than 80 years), income up to Rs 3 lakh is exempt from tax. Income from Rs 300,001 to Rs 5 lakh is taxed at 5 per cent, from Rs 500,001 to Rs 10 lakh at 20 per cent and above Rs 10 lakh at 30 per cent.

For super senior citizens, aged 80 years and above, income up to Rs 5 lakh is exempt from tax. Income from Rs 500,001 to Rs 10 lakh is taxed at 20 per cent and above Rs 10 lakh is taxed at 30 per cent.

However, if an individual’s net taxable income does not exceed Rs 5 lakh (i.e., income after claiming deductions and tax exemptions), then the net tax liability will be zero. This is because an individual can avail tax rebate of up to Rs 12,500 under section 87A.

Stating that India is now the fifth largest economy in the world, the finance minister said: “Fundamentals of the economy are strong and that has ensured macroeconomic stability… and inflation well contained.” The central government’s debt has reduced to 48.7 per cent of GDP from 52.2 per cent in March 2014, Ms Sitharaman said. She said the fiscal plan is based around three main themes: an “aspirational India, economic development for all and a caring society”.

(With Agency Inputs ).