GST sets exemption threshold for tax at Rs.20 lakh

NEW DELHI: The Goods & Services Tax (GST) Council has decided that businesses in the north-eastern and hill states with annual turnover below Rs.10 lakh would be out of the GST net, while the threshold for the exemption in the rest of India would be an annual turnover of Rs.20 lakh.

NEW DELHI: The Goods & Services Tax (GST) Council has decided that businesses in the north-eastern and hill states with annual turnover below Rs.10 lakh would be out of the GST net, while the threshold for the exemption in the rest of India would be an annual turnover of Rs.20 lakh.

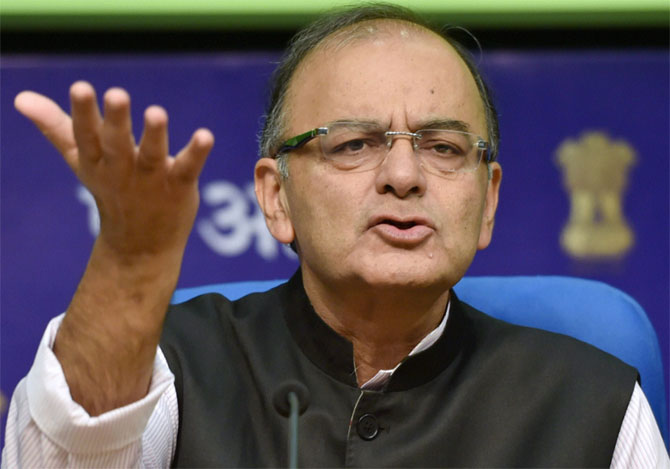

“For GST, the exemption threshold is fixed at Rs.20 lakh,” the Council’s Chairman and Union Finance Minister Arun Jaitley told a news conference at the conclusion of the panel’s first meeting here on Friday.

“So those with a turnover of below Rs.20 lakh annually will be exempted from GST. With the north-east States, the exemption threshold is Rs.10 lakh,” Mr. Jaitley said. The Constitutional Amendment paving the way for the GST has a provision to accord special status to the north-eastern and hill states.

“A higher threshold of Rs.20 lakh (as against earlier proposed limit of Rs.10 lakh) is also a good news,” Rajeev Dimri, Leader, Indirect Tax, BMR Associates, said in an e-mailed statement. “Many small scale traders and service providers would be saved from undertaking GST compliances and it also reduces a substantial burden for tax authorities to assess small time dealers.”

Mr. Jaitley said the Council had also reached consensus on another contentious issue, that of administrative control over indirect tax assessees. States would have sole jurisdiction over assessees (currently in the Value Added Tax (VAT) net at present) having a turnover of Rs.1.5 crore or less, while the administrative control of businesses with a turnover exceeding that limit would be jointly with the central and state governments, Mr. Jaitley said.

On Thursday, Abhishek Mishra, the minister representing Uttar Pradesh, had called for fixing the exemption threshold at Rs.10 lakh. Mr. Mishra had argued against a preliminary proposal for fixing it at Rs.25 lakh, on the grounds that at that level the state could lose 7.1 per cent of its revenue. Delhi Deputy Chief Minister Manish Sisodia, and members from Tamil Nadu and some other states had supported the proposed threshold level of Rs.25 lakh.

The Council also decided that the existing 11 lakh service tax assessees will continue to be under the jurisdiction of the Centre. Since the GST will allow the States to also tax services, over time the revenue officials in the States will be trained after which they will begin assessing assessees in the services sector.

“Retention of administrative control over existing Service Tax assessees by Central authorities highlights an open mindset to facilitate smooth transition to GST,” Mr. Dimri said.

The Council will reconvene on September 30 to finalise the categories of goods and services that will be exempt from the GST. After that, it will meet on October 17, 18 and 19 to fix the slabs and rates at which the GST will be paid by consumers, Mr. Jaitley said.

Compensation formula

The compensation that the Centre would pay to the States for losses of revenue because of the transition to the new regime would be routinely, quarterly or bi-monthly, Mr. Jaitley said. The Council agreed to settle for 2015-16 as the base year for calculating the compensation.

On Thursday, Tamil Nadu had called for ascertaining quantum of compensation based on the average growth rate in the best three of the preceding six years. A formula would be set based on suggestions, Mr. Jaitley said.